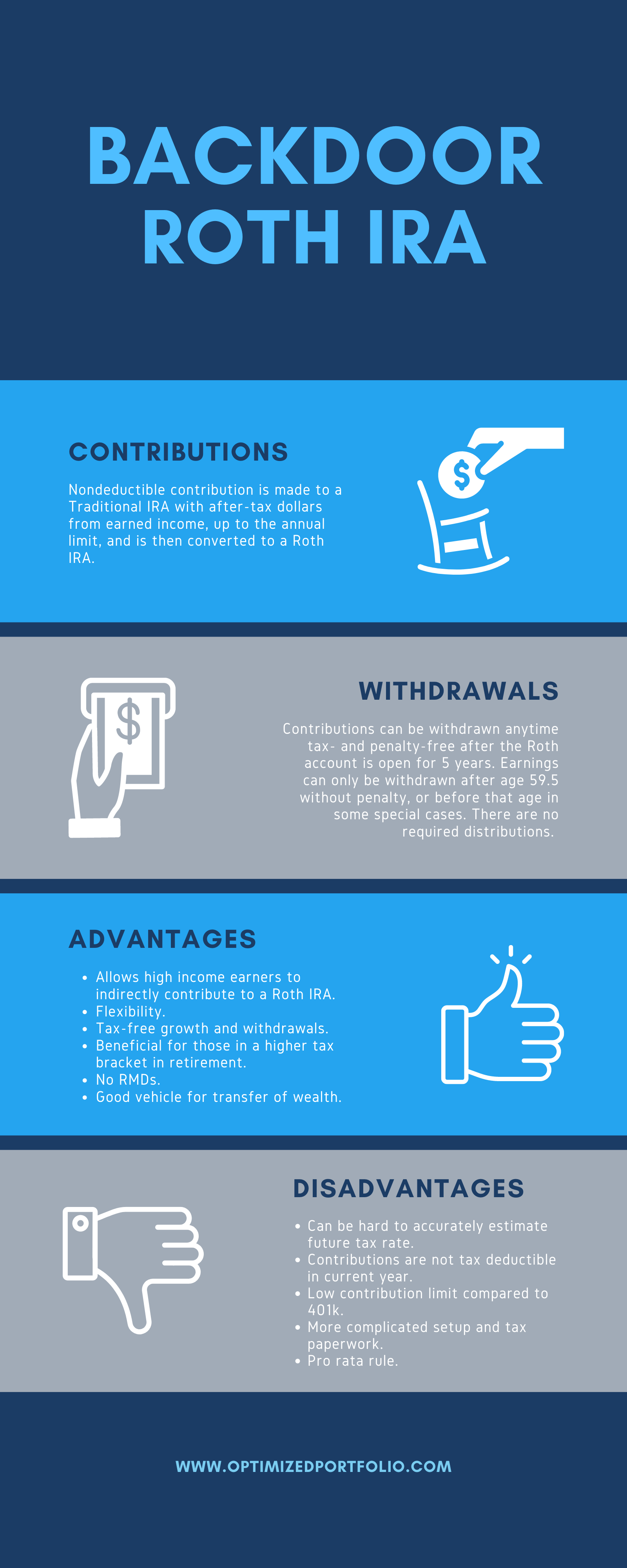

Roth Ira Backdoor Limit 2025. Backdoor roth ira income limits if your modified adjusted gross income (magi) is above certain income limits, then the amount you can contribute to a roth ira. How much can you backdoor into a roth ira?

The maximum total annual contribution for all your iras combined is: For 2025, you can contribute as much as $7,000 to an ira or $8,000 if you’re age 50 and older.

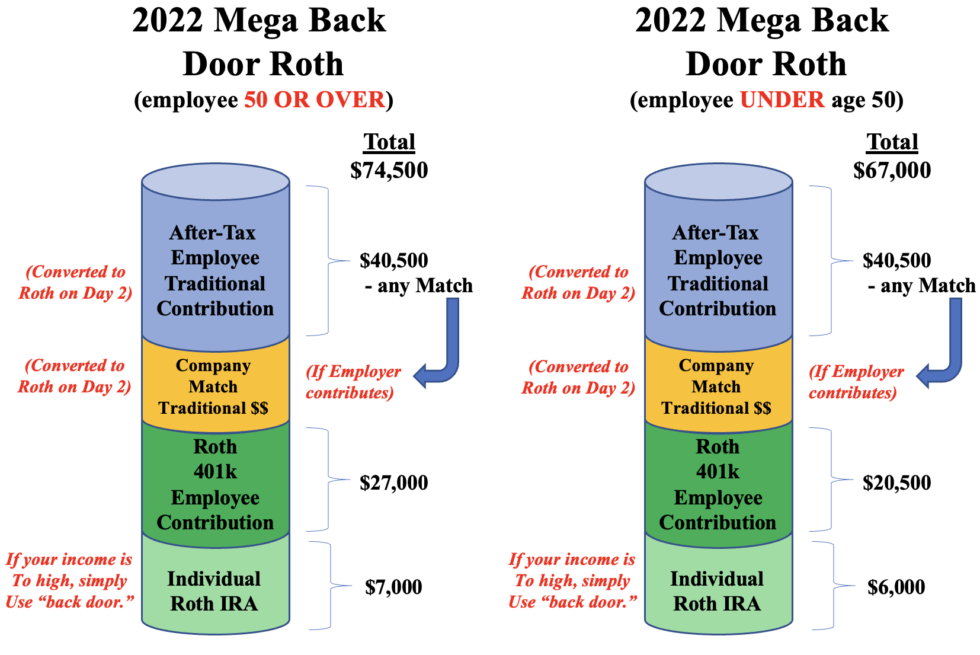

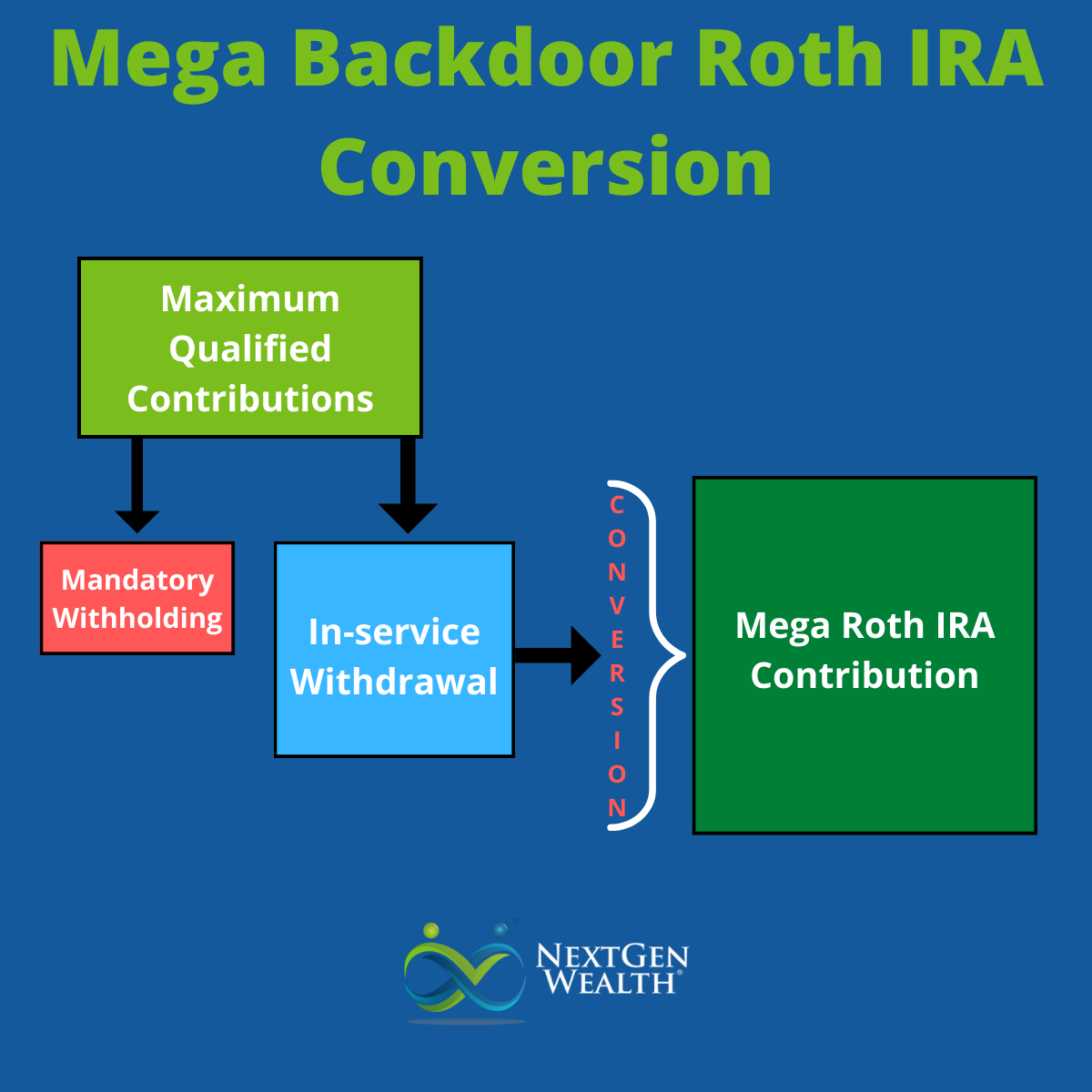

Backdoor Roth Ira Limits 2025 Darb Doroteya, A mega backdoor roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a roth account, based on their income or.

Backdoor Ira Contribution Limits 2025 Rivy Susana, In 2025, the contribution limits rise to $7,000, or $8,000 for those 50 and older.

Backdoor Roth Ira Contribution Limits 2025 Over 50 Mommy Therine, Is the backdoor roth an illegal move?

Mega Backdoor Roth Limit 2025 Cris Michal, So if you want to open an account and then use the backdoor ira method to convert the account.

2025 Roth Ira Contribution Limits Chart Dayle Erminie, Here's how those contribution limits stack up for the 2025 and 2025 tax years.

Backdoor Roth Ira Contribution Limits 2025 Over 55 Pet Lebbie, So if you want to open an account and then use the backdoor ira method to convert the account.

Backdoor Roth IRA Explained What, Where, Why, & How (2025), Is the backdoor roth allowed in 2025?

Backdoor Roth IRA What Is It? When Is It Useful? RGWM Insights, If you're age 50 and older, you.