Qualified Charitable Distribution 2025. Some early adopters of the qualified charitable distribution (qcd) charitable gift annuity have begun to turn their attention to another opportunity to reduce their required. The irs issued a release reminding irs owners aged 70½ and older that they can write off up to $105,000 for a direct donation to a qualified charity in 2025, known as qualified.

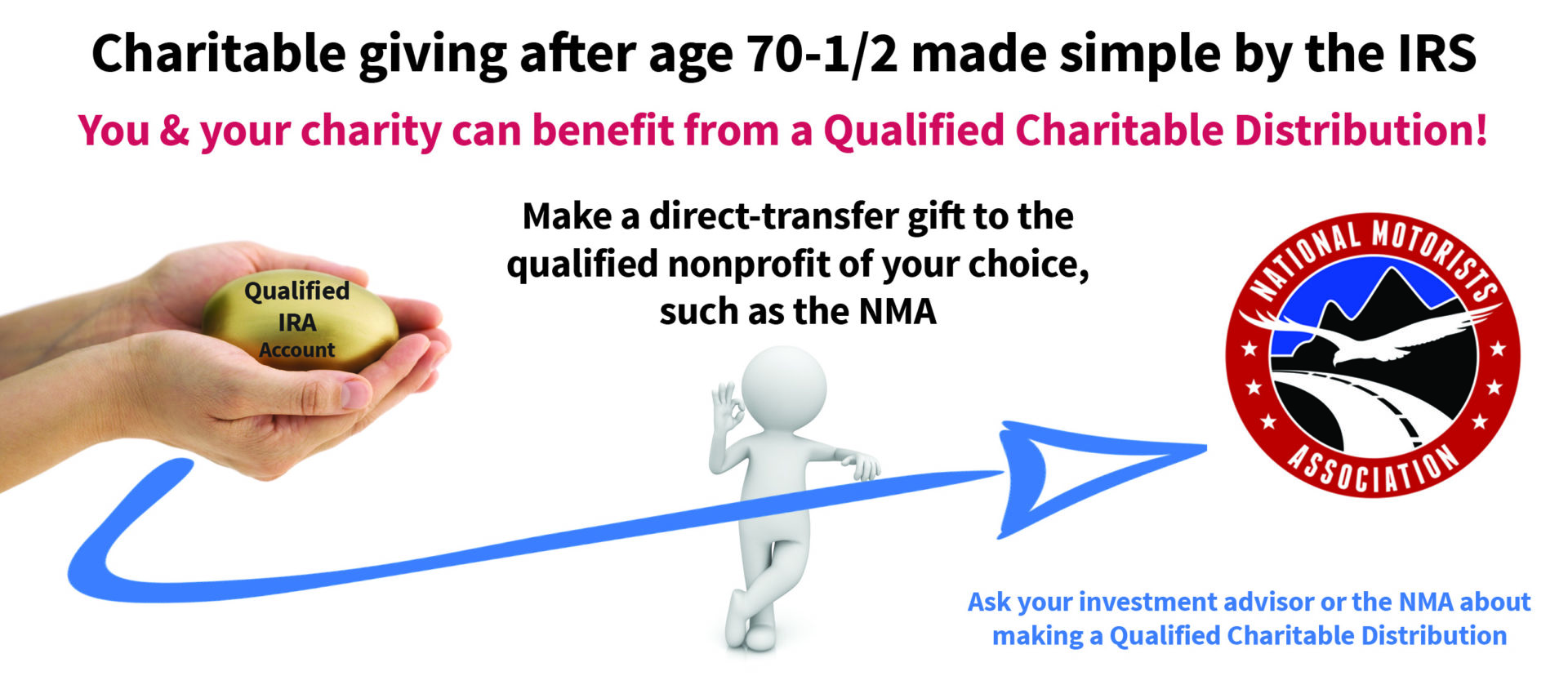

A qualified charitable distribution (qcd) allows individuals who meet a certain criteria to donate to one or more charities they care about directly from a taxable ira instead of taking their. A qcd allows individuals 70½ years and older to directly contribute from an ira to a qualified charity without it counting.

Qualified Charitable Distribution as a Required Minimum Distribution?, Some early adopters of the qualified charitable distribution (qcd) charitable gift annuity have begun to turn their attention to another opportunity to reduce their required.

2025 QCD Donation Limit Increases and Insights VA CPA Firm, A qualified charitable distribution permits a client (and a spouse from a spouse’s own ira or iras) to transfer up to $105,000 in 2025 (and $108,000 in 2025) from.

Know the benefits of giving through a Qualified Charitable Distribution, Discover the process, benefits, and tax advantages of donating from your ira.

Qualified Charitable Distribution from Your IRA Democracy Forward, Qcds can be counted toward.

Qualified IRA Charitable Distribution OneEighty, What's a qualified charitable distribution (qcd)?

Maximizing Tax Benefits Qualified Charitable Distributions (QCD) from, With qcds, retirees can save on taxes by making donations from their iras directly to charity.

A Special Message for NMA SupportersQualified Charitable Distribution, What is a qualified charitable distribution (qcd)?

Don't About Qualified Charitable Distributions, In addition to the numbers shown in “unofficial inflation adjustments for 2025,” practitioners may also wish to know that the limit on qualified charitable distributions from individual retirement.

Qualified Charitable Distributions and Required Minimum Distributions, A qualified charitable distribution (qcd) is an ira withdrawal that goes directly to charity.

Case of the Week Making Qualified Charitable Distributions from IRAs, Some early adopters of the qualified charitable distribution (qcd) charitable gift annuity have begun to turn their attention to another opportunity to reduce their required.