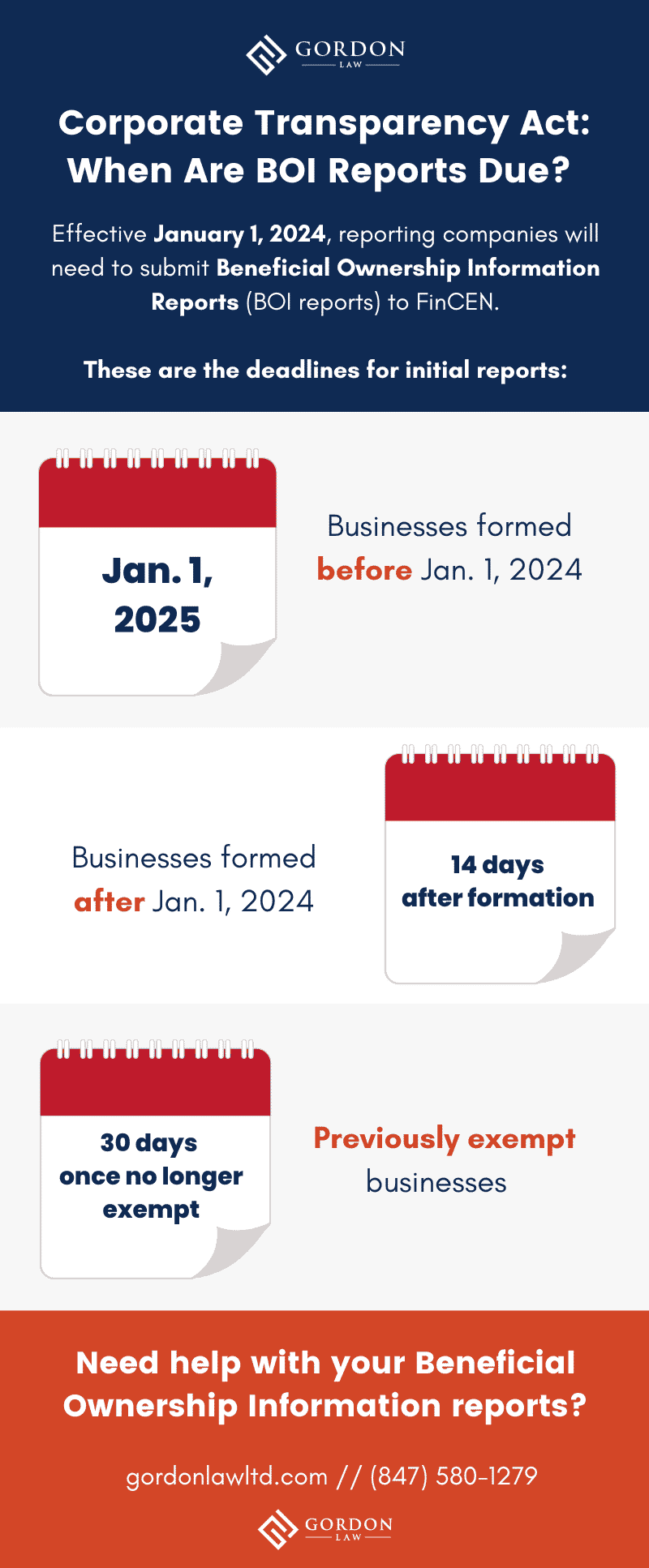

Fincen + Corporate Transparency Act. On april 5, 2025, the financial crimes enforcement network, a bureau of the united states department of the treasury (“fincen” and “treasury,” respectively) issued an advance notice of proposed rulemaking (“anprm”) beginning the process of implementing regulations under the corporate transparency act (“cta”). With the beneficial ownership information reporting requirement imposed by the corporate transparency act effective on january 1, 2025, every “reporting company” must file a report with the financial crimes enforcement network (fincen).

With the beneficial ownership information reporting requirement imposed by the corporate transparency act effective on january 1, 2025, every “reporting company” must file a report with the financial crimes enforcement network (fincen). This article is an updated version of the corporate transparency act requires reporting companies to file with fincen.

With the beneficial ownership information reporting requirement imposed by the corporate transparency act effective on january 1, 2025, every “reporting company” must file a report with the financial crimes enforcement network (fincen).

Corporate Transparency Act Companies to report ownership information, 2025, must report required information to the financial crimes enforcement network (fincen) within 90 days of formation. Enacted by congress in 2025, the cta requires many companies formed or operating in the united states to report information about their beneficial owners to treasury’s financial crimes enforcement network (fincen), which will store this sensitive information in a secure, confidential database.

FinCEN Begins Making Rules For Corporate Transparency Act, Beginning january 1, 2025, the us corporate transparency act (cta) will require “reporting companies” to submit a report to the financial crimes enforcement network (fincen) containing personal information about the reporting company’s “beneficial owners.” On november 16, 2025 fincen issued additional faqs on their website to answer new questions about the reporting process, reporting companies, beneficial owners, company applicants, reporting requirements, initial reports, and reporting company exemptions.

FinCEN Begins Making Rules For Corporate Transparency Act Hong Kong News, For concerns related to the implementation of the corporate transparency act, please contact the office of the inspector general. On march 1, 2025, the u.s.

FinCEN Publishes Reporting Requirements, Definitions of Corporate, Is an online filing service for reporting companies that must file beneficial ownership reports under the corporate transparency act beginning january 1, 2025. The bipartisan corporate transparency act, enacted in 2025 to curb illicit finance, requires many companies doing business in the united states to report information about the individuals who ultimately own or control them.

FinCEN’s final rule implementing the Corporate Transparency Act is a, Enacted by congress in 2025, the cta requires many companies formed or operating in the united states to report information about their beneficial owners to treasury’s financial crimes enforcement network (fincen), which will store this sensitive information in a secure, confidential database. Department of the treasury's financial crimes enforcement network (fincen) issued a final rule on sept.

FinCEN Portal Open for Corporate Transparency Act Reporting Hellmuth, Includes a live q&a with experts. Newly formed entities, created or first registered.

Corporate Transparency Act What You Need to File and When, The relief granted by the court is limited to enjoining the federal government from enforcing the cta against the plaintiffs in the case, the national small business association (“nsba”) and. The corporate transparency act is now poised to take effect on january 1, 2025 (the “effective date”), and will immediately impose sweeping new disclosure duties when new entities are formed.

Corporate Transparency Act ORG, The relief granted by the court is limited to enjoining the federal government from enforcing the cta against the plaintiffs in the case, the national small business association (“nsba”) and. On march 1, 2025, the u.s.

NEW Corporate Transparency Act (CTA) and FinCEN Filing Riverside Filings, Secretary yellen on corporate transparency. District court for the northern district of alabama held the corporate transparency act (the “cta”) unconstitutional.

FinCEN Issues Small Entity Compliance Guide for Corporate Transparency, Brochure introduction to boi reporting. Boi overview with under secretary nelson.

Beginning january 1, 2025, the us corporate transparency act (cta) will require “reporting companies” to submit a report to the financial crimes enforcement network (fincen) containing personal information about the reporting company’s “beneficial owners.”

The bipartisan corporate transparency act, enacted in 2025, created a legal framework to address this critical gap by requiring many companies doing business or registered in the united states to report information to the financial crimes enforcement network (fincen) about who ultimately owns or controls them.