2025 Fsa Maximum Irs. Irs maximum fsa contribution 2025. Employees can now contribute $150 more this.

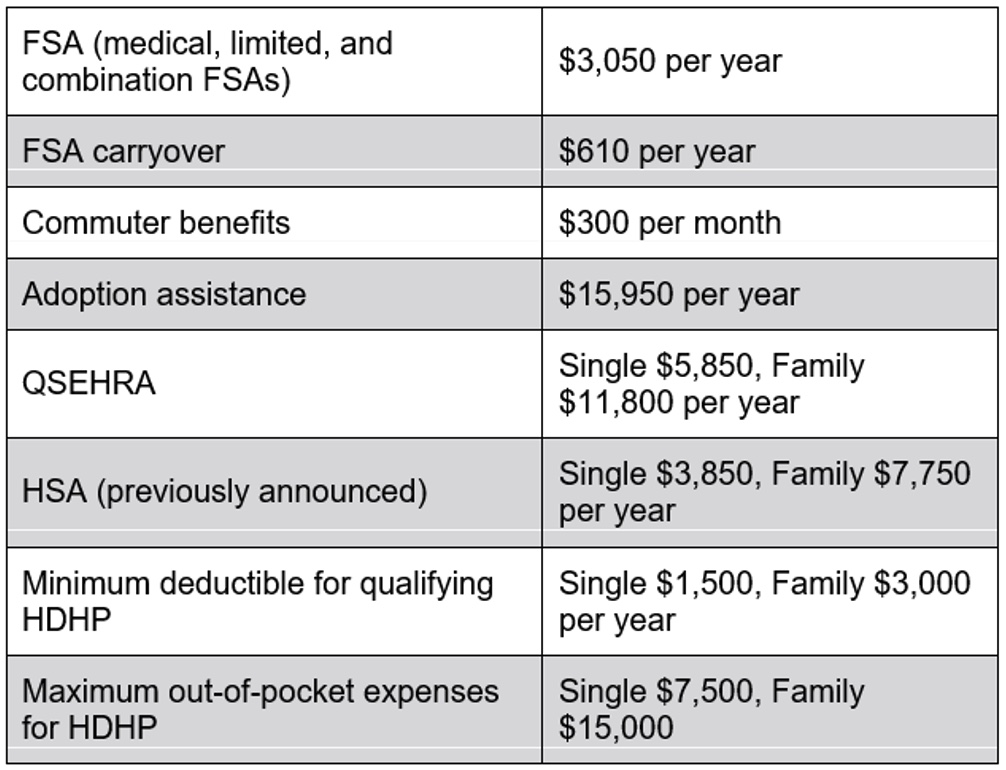

The 2025 maximum fsa contribution limit is $3,200. For unused amounts in 2025, the maximum amount that can be carried over to 2025 is $610.

Irs Fsa Maximum For 2025 Tresa Harriott, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions.

2025 Fsa Limits Irs Increase Chlo Melesa, The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts.

2025 Fsa Limits Increase Daron Emelita, The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts.

Fsa Employer Contribution Max 2025 Calendar Joete Madelin, The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year).

2025 Fsa Maximum Irs Eliza Hermina, Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to flexible spending.

Annual Dependent Care Fsa Limit 2025 Table Tarah Francene, For fsas that permit the carryover of unused amounts, the maximum 2025 carryover amount to 2025 is $640.

Dependent Care Fsa Maximum 2025 Drusi Isadora, If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640 to 2025.

Dependent Care Fsa Limit 2025 Over 65 Kalie Marilin, Learn what the maximum fsa limits are for 2025 and how they work.

Irs Health Fsa Maximum 2025 Herta Ladonna, The irs establishes the maximum fsa contribution limit each year based on inflation.